Open Door Financial loans and doorstep money lending have received reputation as practical and versatile options for individuals in need of fast economic guidance. These types of lending providers make it possible for borrowers to obtain hard cash without having to experience the normal, normally prolonged, financial loan software processes related to banking institutions or other huge economic institutions. While the enchantment of these types of financial loans may possibly lie within their simplicity and accessibility, it’s important to fully understand the mechanisms, pros, and probable pitfalls ahead of taking into consideration this type of monetary arrangement.

The notion behind open up door financial loans revolves about furnishing uncomplicated and quickly usage of money, typically without the need for intensive credit score checks or collateral. This will make these loans captivating to individuals who might not have the best credit rating scores or those who experience financial problems. Unlike standard financial loans that can get times or simply weeks for being permitted, open up doorway financial loans frequently supply dollars to the borrower’s account inside a issue of several hours. This velocity and benefit are two from the most significant aspects contributing to your expanding recognition of these lending providers.

The entire process of applying for these loans is straightforward. Usually, borrowers want to supply simple private data, proof of earnings, and bank details. Since open up doorway loans are often unsecured, lenders tackle extra possibility by not necessitating collateral. Therefore, the curiosity rates and costs connected to these loans tend to be bigger when compared to traditional lending choices. Though this can be a disadvantage, the accessibility and pace of funding frequently outweigh the upper charges For a lot of borrowers in urgent financial predicaments.

Doorstep income lending, as the identify suggests, consists of the shipping and delivery of money on to the borrower’s property. This service is built to cater to These preferring in-person transactions or people that may not have entry to on line banking facilities. A consultant within the lending business will take a look at the borrower’s house at hand about the cash and, in many scenarios, collect repayments on the weekly or regular monthly foundation. This personal touch can provide a sense of reassurance to borrowers, Particularly people who may be cautious of online transactions or are much less informed about digital financial solutions.

Even so, a single will have to look at the bigger fascination prices and charges typically connected to doorstep cash lending. These kind of financial loans are regarded as high-chance by lenders, presented that they are unsecured and that repayment selection is dependent intensely around the borrower’s capability to make payments over time. For that reason, the interest premiums charged may be drastically bigger than These of ordinary loans. Borrowers needs to be careful of the, given that the advantage of doorstep hard cash lending could appear at a considerable Price tag.

Yet another aspect to consider is definitely the repayment versatility that these financial loans provide. Lots of open doorway financial loans and doorstep money lending products and services offer flexible repayment options, which may be effective for borrowers who may not be in the position to decide to stringent payment schedules. On the other hand, this flexibility also can bring on lengthier repayment intervals, which, combined with significant desire prices, can result in the borrower to pay for significantly extra more than the life of the mortgage than they originally borrowed. It’s imperative that you evaluate whether or not the repayment composition of such financial loans is really manageable and according to just one’s economical problem before committing.

One of the important components of open up doorway loans is their capacity to support individuals with weak credit history scores. Regular financial institutions typically deny loans to These with less-than-fantastic credit rating histories, but open doorway lenders are likely to emphasis much more on the borrower’s present-day capacity to repay as opposed to their credit history previous. Whilst This may be advantageous for people planning to rebuild their monetary standing, it’s very important to get mindful on the dangers included. Failing to meet repayment deadlines can even more harm just one’s credit score and likely bring about extra extreme economical troubles down the road.

The acceptance procedure for these loans is frequently quick, with choices designed within a handful of hrs, and resources tend to be offered a similar working day or the next. This immediacy tends to make these loans a lifeline for men and women experiencing unanticipated costs or emergencies, including auto repairs, clinical expenditures, or other unexpected economical obligations. Having said that, the convenience of usage of resources can in some cases produce impulsive borrowing, which could exacerbate economical complications rather than take care of them. Borrowers really should generally look at whether they genuinely require the loan and should they can manage the repayments just before continuing.

A different advantage of doorstep cash lending is usually that it lets borrowers to obtain cash with no require to go to a financial institution or an ATM. This may be notably helpful for those who could are now living in remote spots or have minimal access to money institutions. Also, some borrowers might experience a lot more snug handling a agent in individual, particularly when they've problems about managing economic transactions on line. The personal character with the service can foster a more powerful romance between the lender along with the borrower, but it really is essential to understand that the superior expense of borrowing continues to be a significant consideration.

There is certainly also a particular standard of discretion involved with doorstep hard cash lending. For people who may well not want to reveal their money problem to others, the ability to handle loan preparations within the privateness in their property might be desirable. The personal interaction which has a lender agent may offer you some reassurance, as borrowers can examine any considerations or queries straight with the individual providing the mortgage. This immediate conversation can at times make the lending procedure feel a lot less impersonal than handling a faceless on the internet software.

About the downside, the advantage of doorstep income lending can sometimes bring on borrowers using out various loans at the same time, especially if they come across it tough to maintain up with repayments. This may make a cycle of financial debt that is definitely hard to escape from, specially In the event the borrower will not be handling their finances diligently. Responsible borrowing and a clear comprehension of the personal loan terms are necessary to prevent such scenarios. Lenders may well offer repayment programs that seem versatile, although the superior-interest prices can accumulate speedily, resulting in a big credit card debt stress eventually.

While open up doorway financial loans and doorstep dollars lending present many benefits, such as accessibility, speed, and adaptability, they don't seem to be without the need of their worries. Borrowers really need to diligently evaluate the stipulations of these financial loans to stay away from finding caught in a very financial debt cycle. The temptation of rapid money can sometimes overshadow the extensive-expression fiscal implications, specifically When the borrower is not in a robust place to make well timed repayments.

Among the primary criteria for just about any borrower should be the overall cost of the personal loan, which includes desire costs and any additional expenses. While the upfront simplicity of those financial loans is attractive, the particular amount repaid after a while can be drastically higher than predicted. Borrowers ought to weigh the instant advantages of obtaining cash swiftly from the long-phrase fiscal effects, especially In case the personal loan conditions extend more than many months or maybe years.

Moreover, borrowers should also pay attention to any likely penalties for late or skipped payments. Quite a few lenders impose steep fines for delayed repayments, that may further more increase the total expense of the personal loan. This can make it far more vital for borrowers to ensure that they may have a good repayment approach set up ahead of using out an open doorway bank loan or choosing doorstep money no refusal loans uk lending.

Regardless of the probable downsides, you can find scenarios where by open up door financial loans and doorstep income lending may be effective. For people who require usage of cash rapidly and would not have other feasible monetary solutions, these loans deliver an alternate that will help bridge the gap during tricky occasions. The real key is to work with these financial loans responsibly and assure that they're Portion of a well-considered-out financial approach rather than a hasty determination pushed by instant desires.

In some cases, borrowers could notice that these loans serve as a stepping stone to a lot more secure fiscal footing. By earning well timed repayments, people can exhibit money obligation, which can enhance their credit score scores and allow them to qualify for more favorable bank loan phrases Sooner or later. Having said that, this outcome depends heavily around the borrower’s ability to handle the mortgage efficiently and stay away from the pitfalls of large-curiosity debt.

It’s also really worth noting that open up doorway loans and doorstep income lending are frequently matter to regulation by economic authorities in numerous countries. Lenders must adhere to sure rules pertaining to transparency, curiosity prices, and repayment conditions. Borrowers really should guarantee that they are addressing a respectable and regulated lender to stay away from probable frauds or unethical lending tactics. Checking the lender’s qualifications and looking through evaluations from other borrowers can assist mitigate the risk of falling sufferer to predatory lending strategies.

In conclusion, open doorway financial loans and doorstep hard cash lending supply a convenient and accessible Answer for individuals struggling with speedy financial issues. When the convenience of getting these loans is usually captivating, it’s vital to method them with caution and a transparent comprehension of the involved prices and threats. Borrowers should really cautiously evaluate their capacity to repay the personal loan within the agreed-on terms and be aware of the prospective extended-expression fiscal implications. By doing so, they could make educated selections that align with their financial targets and stay away from the frequent pitfalls of superior-curiosity lending.

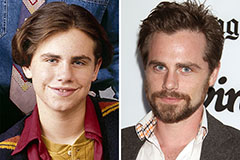

Rider Strong Then & Now!

Rider Strong Then & Now! Ben Savage Then & Now!

Ben Savage Then & Now! Monica Lewinsky Then & Now!

Monica Lewinsky Then & Now! Lacey Chabert Then & Now!

Lacey Chabert Then & Now! Rossy de Palma Then & Now!

Rossy de Palma Then & Now!